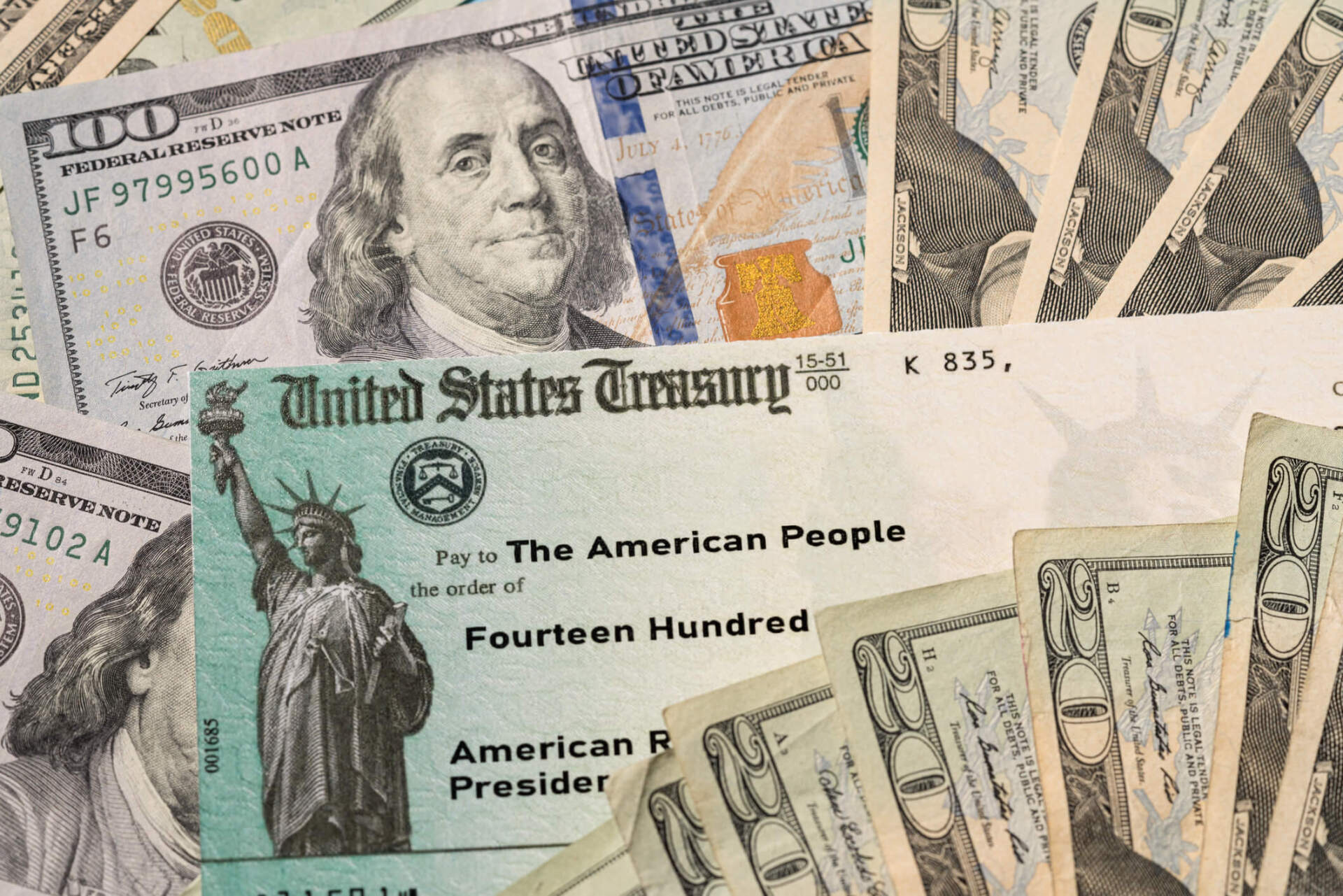

The American Rescue Plan, commonly known as the third stimulus, provided many taxpayers relief for the 2020 and 2021 years, while also generating many questions. Is the stimulus check taxed? Who is eligible for new tax credits? What is changing for people on unemployment?

The Third Stimulus Check

The base payment this time around is $1,400. However, not everyone will receive that amount. The first stimulus check went to individuals making less than $99,000 and couples making less than $198,000. The third stimulus changes those income thresholds.

This time, the cap is $80,000 for single filers and $160,000 for joint filers. Those who make between $75,000 and $80,000 get a reduced amount. Similarly, joint filers see a reduction if their income tops $150,000.

The good news? The third stimulus isn’t taxable. The IRS will not count it as income on your tax return.

Improvements in Unemployment

Notably, a provision in the American Rescue Plan gives extra relief to the unemployed. Up to $10,200 in unemployment benefits are tax exempt. If you received unemployment in 2020 and earned less than $150,000 in adjusted gross income, only benefits that go over $10,200 count for your taxes.

If you have already filed your 2020 tax return and counted the first $10,200 as income, the IRS announced that it will send an automatic credit for the adjusted income. There is no need for you to claim the credit or submit an adjustment to your 2020 tax return.

New Credits for Families

Families benefit from an expanded child tax credit. A few things to note about the 2021 child tax credit:

- The third stimulus allows 17-year-old children to qualify for the child tax credit.

- The credit increases to $3,000 per child for most families. Children under six years of age qualify for $3,600.

- The $2,500 base earnings has been removed.

- Finally, half of the 2021 child tax credit is to be paid in advance by the IRS through periodic payments to families. These payments will be sent between July-December 2021

This child tax credit phases out once a family’s income reaches $75,000 (single filers), $112,000 (heads of household), and $150,000 (joint filers). Unlike the typical child tax credit, this one is fully refundable, even for lower-income families who previously could claim only $1,400.

For families with an Adjusted Gross Income (AGI) of $400,000 or lower, but who don’t qualify for the above-mentioned tax credit, will likely still be able to claim the regular tax credit of $2,000 per child. The child tax credit will be reduced for families with an AGI higher than 400,000.

Determining Eligibility

Eligibility for credits and advance payments will be based on information from your 2020 tax return. If you haven’t filed your 2020 taxes, then the IRS will pull information from your 2019 tax return.

The IRS is required by American Rescue Plan to establish an online portal for updating changes such as your marital status, eligible children, and income. If you believe that changes to any of these will affect your eligibility, credits, or payments, watch for the IRS to announce the portal and file your changes as soon as possible.