Annuities can be an attractive tax advantage to investors because they allow investments to grow tax-free until the moneys are withdrawn. This includes dividends, interest and capital gains. Investors have the option to fully reinvest the interest, dividends, and capital gains earned while these monies remain in the annuity. This allows your investment to

grow without being reduced by tax payments.

While this tax advantage can attract investors to investing in annuities, it can also become a trap for the unwary. Let’s unpack some of the complexities and simplify some of the rules of annuity taxation in order to inform you before navigating the waters of annuity investments.

Are Annuities Taxable?

The short answer is yes, annuities are taxable. However, annuities are what is referred to as “tax deferred” – meaning that the earnings can potentially grow tax free while the monies remain in the annuity. Taxes are not due until you receive income payments from your annuity. Withdrawals and lump sum distributions from an annuity are taxed as ordinary income, which is taxed at a different income tax rate than other potential investment options which are taxed at capital gains rates.

Taxation of Annuities

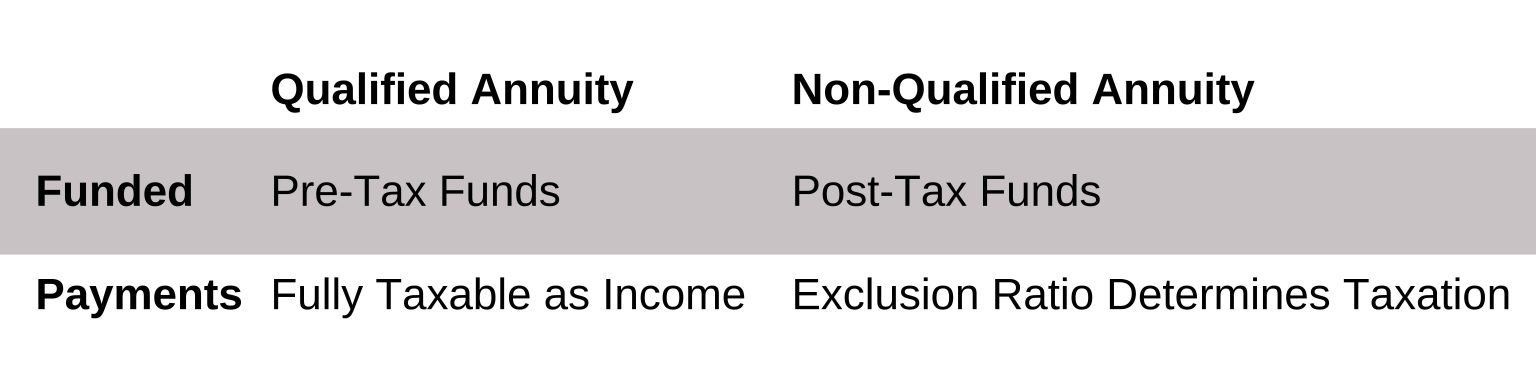

The tax ramifications of investing in an annuity are largely driven by whether or not the annuity is classified as qualified or non-qualified.

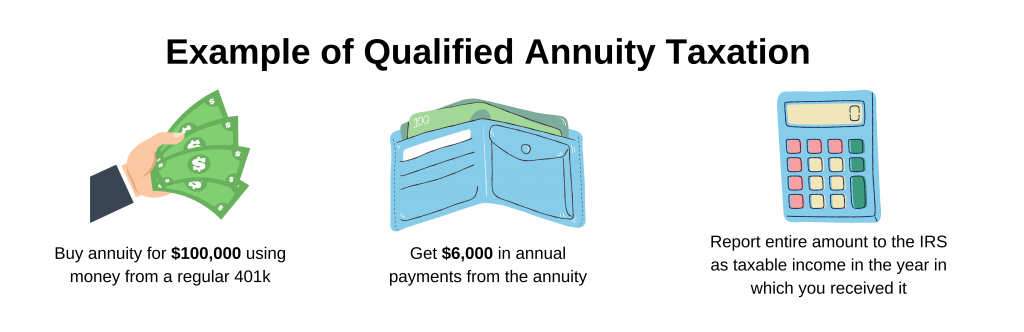

Qualified Annuity Taxation

If an annuity is funded with pretax funds (money on which no taxes have been previously paid), then it is classified as a qualified annuity. These types of annuities are commonly funded with money from tax deferred retirement accounts, such as 401(k)s or IRAs.

Any payments received from a qualified annuity are fully taxable as income because no tax has been paid historically on the funds.

Non-Qualified Annuity Taxation

Annuities purchased with a Roth IRA or Roth 401(k) could potentially be completely tax free if certain requirements are met.

If the annuity was purchased with after-tax funds, then it’s non-qualified. Non-qualified annuities require tax payments on only the earnings.

The exclusion ratio is an actuarial calculation which determines what portion of annuity payments are taxable versus nontaxable. This exclusion ratio was crafted with the goal of identifying which portion of any annuity withdraws is derived from previously taxed principal amounts versus any growth in the annuity from earnings which have not been previously taxed (i.e. tax deferred).

Factors that are considered by the actuaries in determining the exclusion ratio include the initial principal payments, length of time the annuity has been established, and the growth of the earnings in the annuity.

Annuity Payout Taxation

The typical approach to annuity payouts is to receive a steady stream of payments. Each monthly annuity income payment from a non-qualified plan is made up of two parts. The tax-free part is considered a return of the net cost for purchasing the annuity. The remaining is considered to be earnings, and it subject to income tax. The idea is to evenly divide the principal amount — and its tax exclusions — out over the expected number of payments. The rest of the amount in each payment is considered earnings subject to income tax.

Since the exclusion ratio is intended to spread principal withdrawals over the annuitant’s life expectancy, if an

annuitant lives longer than his or her actuarial life expectancy, any annuity payments received after that age are fully taxable.

Exclusion Ratio Example

- Life expectancy is 10 years at retirement.

- Annuity purchased for $50,000 with post-tax money.

- Annual payments of $5,000 – 10 percent of your original investment – is non-taxable.

- Annuity lives longer than 10 years.

- Any monies received beyond that 10-year-life expectation will be taxed as income- it is deemed to be earnings since the exclusion ratio spreads previously taxed principal payments over actuarial life expectancy.

Annuity Withdrawal Taxation

Timing and approach to withdraws of monies from annuities has a determining impact on how it is taxed.

Like most retirement investment vehicles, if a withdrawal is made from an annuity before the age of 59 ½, 10 percent penalty may be assessed on the taxable portion of the withdrawal.

If after age 59 ½ a lump sum withdrawal is taken, rather than receiving steady income stream payments, it will be considered a taxable event and tax will be assessed on the entire amount of earnings withdrawn in the year of the withdrawal.

Any remaining monies remaining in an annuity account is deemed by the IRS to be interest and subject to taxes.

Inherited Annuity Taxation

The same tax rules apply to the

beneficiary of an inherited annuity. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed. Principal that was not taxed and earnings will be subject to taxation as income. The amount of previously taxed principal included in each annuity income payment is considered excluded from federal income tax requirements. This is known as the exclusion amount.

Contact Us Today!

Our Tax Advantage team can provide you with the tax expertise you can count on! Whether it’s for your business or for yourself, you can contact us today by visiting our

Contact Page or calling us at

904-241-0050.